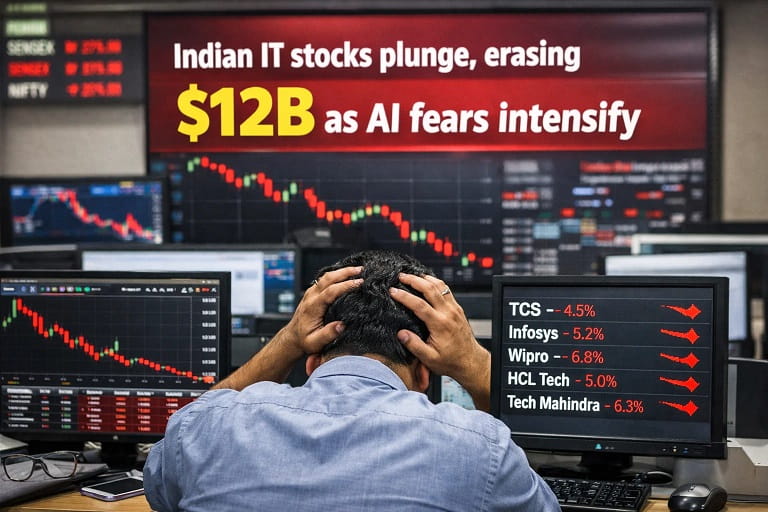

Indian IT Stocks Plunge, Erasing $12 Billion as AI Fears Intensify

Indian IT heavyweights like TCS, Infosys, Wipro, and others took a sharp hit on February 12, 2026, with the sector shedding roughly $12 billion in market value in a single session. The Nifty IT index plunged over 5%—its steepest daily drop in months—dragging the broader market lower and pushing the index to a near 10-month low.

This sell-off stems from renewed worries that rapid advances in AI tools could disrupt the labor-intensive outsourcing model that powers much of India’s $280+ billion IT services industry. Global software stocks have been under pressure for similar reasons, and the pain has spilled over to Indian names.

What Triggered the Sharp Drop Today

The immediate spark came from a mix of factors, but AI disruption fears were front and center:

- Anthropic’s Claude Cowork Push — Recent updates to Anthropic’s AI tools (backed by Amazon and Google) have shown strong capabilities in automating tasks like coding, legal analysis, data processing, and even full workflow delegation. Investors fear these could replace chunks of work currently handled by Indian IT firms.

- Strong US Jobs Data — The latest US employment report came in hotter than expected, reducing hopes for aggressive Federal Reserve rate cuts. Higher-for-longer rates hurt growth-sensitive tech and IT stocks.

- Global Tech Weakness — The sell-off mirrored sharp declines in US software and SaaS names last week, where fears of AI eating into traditional software revenues wiped out hundreds of billions.

The Nifty IT index fell around 5.5% intraday, with frontline names like TCS, Infosys, and Wipro each sliding 4–5%. Smaller names like Coforge and Oracle Financial Services dropped even more (up to 6%). The combined market cap of Nifty IT constituents dropped by approximately ₹1.3 lakh crore (about $15–16 billion at current exchange rates), though some reports pegged the figure closer to $12 billion depending on closing levels and exact constituents.

Timeline of the IT Sector’s Rough Start to 2026

The sector has been under pressure since the start of the year:

- Early January — Mild profit-taking after 2025’s gains.

- Late January — First wave of AI automation fears from new Anthropic features.

- Early February — Global software sell-off intensifies; Indian IT follows.

- February 12 — Nifty IT plunges 5%+, worst single-day fall since mid-2025.

Year-to-date, the Nifty IT index is down around 12–13% in 2026 after already losing 12.6% in 2025 — making it one of the weakest sectoral performers.

Why AI Disruption Fears Are Hitting Indian IT Hard

Indian IT services rely heavily on large-scale, human-led projects — coding, testing, maintenance, support, and consulting for global clients. Tools like advanced Claude agents or similar systems from OpenAI, Google, and others are showing the ability to automate entire workflows, raising questions about long-term demand.

Analysts point out:

- Pricing pressure — Clients may demand lower rates as AI handles more routine tasks.

- Deal flow slowdown — New contracts could shrink or shift to AI-native vendors.

- Margin squeeze — Firms may need heavy re-skilling and investment to stay relevant.

That said, many experts believe the reaction is overdone. Indian IT giants are already investing billions in AI platforms (TCS’s Ignio, Infosys’s Topaz, Wipro’s ai360), and the sector’s deep client relationships and domain expertise provide a buffer. The consensus view: AI will disrupt, but it will also create new opportunities in AI implementation, integration, and management services.

Market Reactions and What Investors Are Saying

- Stock Moves — TCS slipped below ₹10 lakh crore market cap briefly; Infosys, Wipro, Tech Mahindra, HCL Tech, and LTIMindtree all down 4–6%.

- Broader Impact — Nifty 50 and Sensex ended 0.5–0.7% lower, with IT dragging the indices.

- Analyst Takes — “The sell-off is sentiment-driven more than fundamentals,” said one Geojit strategist. Others see it as a healthy correction after years of premium valuations.

On social media and trading forums, reactions range from panic (“IT is finished”) to calm (“Buy the dip — AI needs Indian talent to implement it”).

Looking Ahead: Will This Be a Short Dip or a Longer Slump?

Most analysts expect volatility to continue through February as more AI tool updates roll out and US Fed commentary keeps rates in focus. A bounce could come if Q3 earnings (starting soon) show stable deal wins and AI revenue growth.

For long-term investors, the view is cautious optimism: Indian IT will adapt and thrive in an AI world, but near-term headwinds remain.

If you’re holding IT stocks, this week has been painful — but history shows these sectors often recover strongly once fears peak and earnings prove resilient.

Quick FAQs on the IT Sell-Off

Why did Indian IT stocks fall so sharply today? Fears that new AI tools (like Anthropic’s Claude Cowork) could automate outsourced work, plus fading hopes of quick US rate cuts after strong jobs data.

How much value was wiped out? Around ₹1.3 lakh crore (roughly $15–16 billion) for Nifty IT stocks in one session, with some estimates closer to $12 billion depending on exact closing levels.

Is this the end for Indian IT? No — the sector is adapting fast with its own AI platforms. This looks more like a sentiment-driven correction than a structural collapse.

Should investors buy the dip? Depends on horizon — long-term yes for quality names like TCS and Infosys; short-term caution due to volatility.

What’s next for Nifty IT? Watch Q3 earnings starting mid-February — any sign of steady deal wins could trigger a rebound.