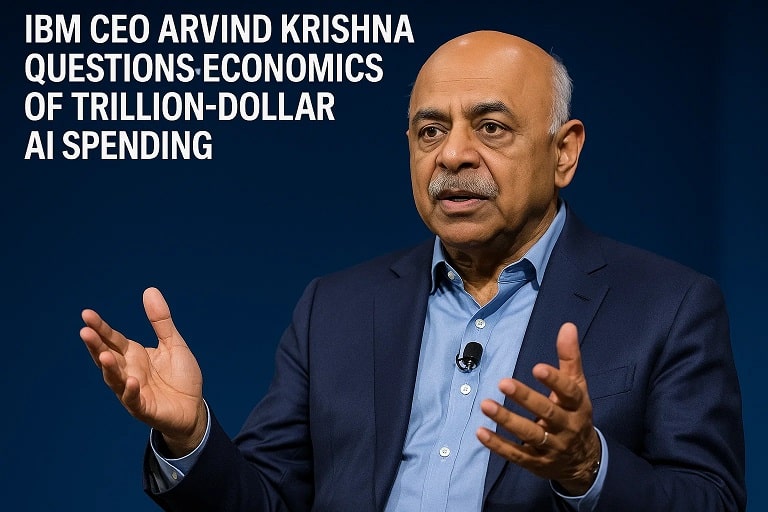

IBM CEO Arvind Krishna Questions Economics of Trillion-Dollar AI Spending: ‘No Way’ It Pays Off at Current Costs

In a candid revelation that’s sending shockwaves through Silicon Valley and beyond, IBM CEO Arvind Krishna has thrown cold water on the AI hype machine, declaring there’s “no way” the tech industry’s projected $8 trillion splurge on data centers will yield returns under today’s infrastructure economics. Speaking on the Verge’s Decoder podcast on December 1, 2025, Krishna unleashed a blistering “napkin math” takedown, warning that such CapEx would demand $800 billion in annual profits just to service the interest— a figure dwarfing the combined earnings of Big Tech’s titans. As AI fervor drives Nvidia’s market cap past $3.5 trillion and hyperscalers like Microsoft and Amazon race to build AGI-enabling superclusters, Krishna’s skepticism arrives at a precarious moment: global AI investments hit $200 billion in Q3 2025 alone, yet profitability remains elusive. With IBM positioning its watsonx platform as a leaner alternative, this critique spotlights a brewing bubble—or a necessary reality check—in the $1 trillion AI gold rush.

The Decoder Bombshell: Krishna’s Stark Warning on AI’s Cost Conundrum

Krishna, steering IBM through its AI pivot since 2020, didn’t mince words during the hour-long interview with Verge’s Nilay Patel. “If you do the math, there’s no way this is going to pay off at today’s infrastructure costs,” he stated, framing the issue as a fundamental mismatch between explosive demand and prohibitive supply-side hurdles. His target? The “trillion-dollar” (or more) frenzy for GPU-packed data centers, where power-hungry Nvidia H100s guzzle electricity like small nations, and construction timelines stretch years amid chip shortages.

Breaking Down the ‘Napkin Math’: Why $8 Trillion Spells Trouble

Krishna’s back-of-the-envelope calculus is deceptively simple yet devastating:

- CapEx Projection: $8 trillion over the next 3-5 years for AI infrastructure, per industry forecasts from Goldman Sachs and McKinsey.

- Interest Burden: At a conservative 10% borrowing rate, that’s $800 billion yearly in interest payments alone—equivalent to Apple’s entire 2024 profit or the GDP of the Netherlands.

- Revenue Reality: Current AI monetization (e.g., via cloud services) generates ~$100 billion annually across majors; scaling to $800 billion would require 8x growth overnight, improbable without breakthroughs.

He pinpointed two choke points: soaring energy costs (data centers could consume 8% of global electricity by 2030) and chip inefficiencies. “We need nuclear power or something radical for cheap energy,” Krishna mused, echoing calls for small modular reactors (SMRs) to slash per-kWh rates from $0.10 to under $0.03.

IBM’s Contrarian Stance: Efficiency Over Extravagance

Unlike hyperscalers betting the farm on scale, IBM champions “hybrid AI” via watsonx—open-source models fine-tuned on enterprise data, costing 50% less to deploy than proprietary LLMs like GPT-5. Krishna dismissed bubble fears but urged pragmatism: “We’re not in an AI bubble; we’re in an infrastructure bottleneck.”

A Timeline of AI’s Escalating Spend: From Hype to Hefty Bills

AI’s investment arc has ballooned from R&D curiosities to CapEx colossi, with 2025 marking the tipping point. Key inflection moments:

| Year | Milestone | Investment Scale | Outcome |

|---|---|---|---|

| 2017 | DeepMind’s AlphaGo Triumph | $1B (Google acquisition) | Sparks enterprise AI pilots; early ROI elusive. |

| 2020 | COVID AI Surge | $50B global (healthcare focus) | IBM Watson Health pivot; mixed results lead to 2021 divestiture. |

| 2023 | ChatGPT Mania | $100B (Nvidia-led boom) | Data center race ignites; hyperscalers commit $200B pipeline. |

| 2024 | AGI Arms Race | $500B CapEx pledges (MSFT/AMZN) | Power crises emerge; US DOE fast-tracks SMR permits. |

| Q3 2025 | Trillion-Dollar Threshold | $200B quarterly spend | Krishna’s critique drops amid 20% energy cost hikes. |

| Dec 2025 | Decoder Wake-Up Call | Projections hit $8T cumulative | Bubble debates rage; IBM stock +3% on efficiency narrative. |

Echoes from IBM’s Past: Lessons from Watson’s $4B Fumble

Krishna reflected on IBM’s 2010s Watson debacle—a $4 billion bet on healthcare AI that underdelivered due to data silos—positioning today’s caution as hard-won wisdom.

Latest Buzz: December 2025 Reactions Ignite AI Accountability

Krishna’s podcast drop on December 1 has fueled a firestorm, trending #AIBubble on X with 50K+ posts by December 3. Hacker News threads dissected the math, with top comments hailing it as “the reality check Big Tech needs.” Business Insider’s coverage amplified the quote, drawing 1M views overnight.

X Frenzy: From Skeptics to Defenders

Posts ranged from “IBM CEO just killed the AI hype—$800B profits? Dream on” (@cryptogon, 34 views) to endorsements: “Krishna’s napkin math is spot-on; time for efficient AI, not endless CapEx” (@AlexNguyen65, 22 views). Viral shares from @betterhn300 linked HN discussions, underscoring tech community’s divide.

Related News: Broader AI Economics Under Scrutiny

Krishna’s salvo syncs with mounting pressures:

- Nvidia’s Chip Crunch: December 2 reports of H200 delays push data center costs 15% higher, validating infrastructure woes.

- Microsoft’s $100B Stargate: November 2025 pledge for OpenAI supercomputer draws parallels to Watson’s overreach.

- EU AI Act Fines: $1B penalties loom for inefficient models, favoring IBM’s governance-focused approach.

- Quantum Crossover: Krishna teased IBM’s 1,000-qubit Condor as a CapEx-light path to AGI, per Decoder.

Bubble or Breakthrough? Peers Weigh In

OpenAI’s Sam Altman countered on X: “Scale wins, but efficiency matters”—a nod to Krishna without concession.

Future Scopes: Rethinking AI’s Path to Profitability

By 2030, Krishna envisions a “rightsized” AI ecosystem: hybrid clouds slashing energy 40%, SMRs powering 20% of centers, and edge computing curbing centralization. IBM’s roadmap? Double watsonx revenue to $20B via enterprise fine-tuning, betting on $500B sustainable market over $8T excess.

Innovation Imperatives

- Energy Revolution: Nuclear and geothermal to halve costs, per IAEA 2025 forecasts.

- Chip Evolution: Post-Moore’s Law optics could cut training expenses 70%.

- Regulatory Reckoning: US antitrust probes may cap hyperscaler dominance.

Optimists see $2T ROI by 2035; skeptics, a 2027 correction mirroring crypto’s winter.

Related Impacts: From Markets to Morality

Krishna’s critique reverberates:

Market Mayhem: Stocks and Strategies Shift

Nvidia dipped 2% intraday December 2; IBM surged 4%, signaling a flight to efficiency plays. VCs pivot $50B from raw infra to software layers.

Ethical Edges: Sustainability Spotlight

Data centers’ 2% global emissions draw ESG ire; Krishna’s call accelerates green mandates, potentially saving $100B in carbon taxes.

Workforce Waves

AI job displacement fears ease if CapEx cools, but upskilling booms—IBM’s 100K apprenticeships as blueprint.

Geopolitical Gambits

US-China chip wars intensify; Krishna’s quantum push bolsters Western edge.

Big Tech AI CapEx: A Comparative Snapshot Table

| Company | 2025 CapEx Projection ($B) | Focus | Krishna Critique Fit |

|---|---|---|---|

| Microsoft | 75 | Azure/OpenAI clusters | High—$750B cumulative risks interest overload. |

| Amazon | 65 | AWS Graviton chips | Medium—efficiency gains but scale still CapEx-heavy. |

| 50 | TPU v5 pods | High—energy guzzlers amid $8T total. | |

| Meta | 40 | Llama fine-tuning | Low—open-source leaner, aligns with IBM. |

| IBM | 10 | watsonx hybrid | Low—ROI-focused, $20B revenue target. |

Frequently Asked Questions (FAQs) on IBM CEO’s AI Spending Skepticism

What Exactly Did Arvind Krishna Say About AI Costs?

He argued $8T in data center CapEx requires $800B annual profits for interest alone—unfeasible at current energy/chip prices.

Is This a Sign of an AI Bubble?

Krishna says no bubble, but an infrastructure mismatch; echoes 2010s Watson lessons without panic.

How Does IBM Plan to Profit from AI Differently?

Via watsonx: efficient, enterprise-tuned models costing 50% less, targeting $20B revenue by 2027.

Will This Slow Big Tech’s AI Investments?

Unlikely short-term—pledges locked—but could shift $100B to edge/hybrid by 2026.

What Solutions Did Krishna Propose?

Cheaper power (nuclear), efficient chips, and governance to unlock true ROI.

Impact on Investors?

Pivot to efficiency stocks like IBM (+4% post-podcast); hyperscalers face 10% valuation scrutiny.