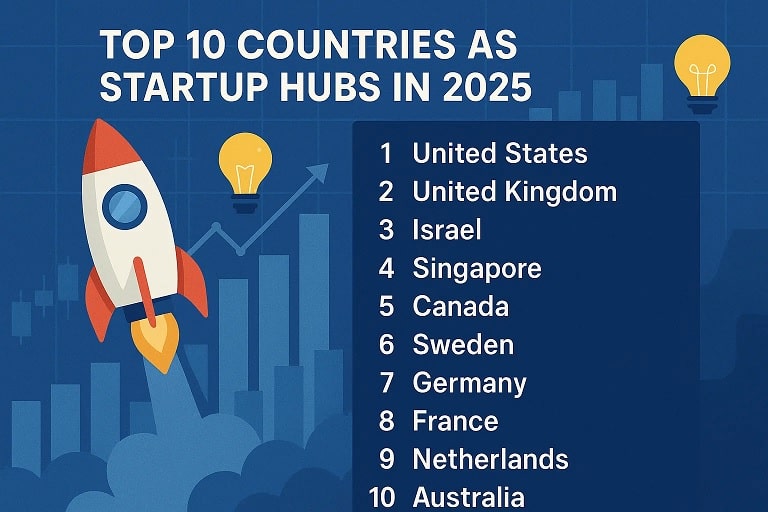

Top 10 Countries Dominating the Global Startup Scene in 2025

August 17, 2025 – Global Innovation Wire – In a year marked by rapid technological advancements and shifting economic landscapes, the United States continues to reign supreme as the world’s premier startup hub, according to the latest Global Startup Ecosystem Index released by StartupBlink. The annual report, which evaluates over 100 countries based on factors like ecosystem strength, unicorn production, funding availability, talent pool, and innovation output, highlights a mix of established powerhouses and rising stars reshaping the entrepreneurial world.

The 2025 index underscores the U.S.’s unassailable lead, boasting a score nearly four times that of its closest rival, the United Kingdom. However, signs of maturation are evident, with the U.S. experiencing its slowest growth rate among the top 10 at just 18.2%. Meanwhile, Singapore’s meteoric rise to fourth place marks a historic milestone, as it becomes the first nation outside the traditional quartet of the U.S., UK, Israel, and Canada to crack the top four, fueled by a blistering 44.9% growth rate and dominance in fintech and e-commerce.

Europe shines brightly with six countries in the top 10, led by the UK’s resilient ecosystem, which widened its gap over Israel despite a slight dip in city representations. Israel holds steady in third, leveraging its “Startup Nation” reputation amid geopolitical challenges, while Canada slips to fifth amid slower growth. Sweden, Germany, France, Netherlands, and Australia round out the list, each benefiting from strong policy support, talent influx, and sector-specific strengths like AI and cleantech.

Experts attribute these rankings to a post-pandemic rebound in venture capital, with global funding hitting record highs in AI and sustainability startups. “The 2025 landscape shows diversification beyond Silicon Valley, with Asia and Europe closing the gap through targeted incentives and digital infrastructure,” said StartupBlink CEO Dmitriy Kustov in the report’s foreword. However, challenges loom: rising interest rates and talent shortages could hinder emerging hubs.

As entrepreneurs eye relocation, Singapore’s tax perks and Israel’s innovation density stand out, while the U.S. grapples with regulatory hurdles. Stay tuned for deeper dives into what this means for global founders.

Full Brief on Top 10 Countries as Startup Hubs in 2025

The top 10 countries as startup hubs in 2025, based on the StartupBlink Global Startup Ecosystem Index, reflect a blend of mature ecosystems with deep funding pools and agile newcomers excelling in niche sectors. This ranking evaluates quantitative metrics like startup density, unicorn valuations, and investment volumes, alongside qualitative factors such as regulatory ease and entrepreneurial culture. The U.S. leads with unparalleled scale, hosting 32 cities in the global top 100, though its growth is slowing. The UK follows, bolstered by London’s fintech prowess, while Israel’s per-capita innovation remains unmatched. Singapore’s ascent highlights Asia’s surge, driven by government-backed initiatives. Canada, despite a dip, benefits from multicultural talent. European entries like Sweden and Germany emphasize sustainable tech, with France and the Netherlands gaining from EU-wide collaborations. Australia closes the list, leveraging its Asia-Pacific proximity for market expansion.

Details on Each Top 10 Country

- United States: Home to Silicon Valley and New York, the U.S. boasts over 50,000 startups and $150 billion in annual VC funding. Key strengths include access to top universities (e.g., Stanford, MIT) and a robust exit market via IPOs. However, high competition and living costs pose challenges. Number of cities in global top 1,000: 81 (down from 85 in 2024).

- United Kingdom: London’s ecosystem scores twice that of Paris, with strengths in fintech (e.g., Revolut) and AI. Post-Brexit incentives like the Scale-up Visa attract talent. Growth rate: 26%. Cities in global top 1,000: 68.

- Israel: Dubbed “Startup Nation,” it leads in cybersecurity and deep tech, with 12 cities in the global top 1,000. Tel Aviv’s ecosystem rivals Silicon Valley per capita. Growth rate: 20.6%, impacted by regional tensions.

- Singapore: Fastest grower at 44.9%, excelling in fintech and blockchain. Government programs like Startup SG provide grants up to $500,000. Ranks #2 globally in e-commerce.

- Canada: Toronto and Vancouver drive AI innovation (e.g., Shopify). Growth rate: 18.8%. Benefits from immigration policies but faces funding concentration issues. Cities in global top 1,000: 39.

- Sweden: Stockholm’s unicorn factory (e.g., Spotify, Klarna) leads EU growth at over 30%. Emphasizes sustainability; 19 cities in global top 1,000, up from 12.

- Germany: Berlin’s transportation tech ranks #5 globally. Growth rate: 28.4%. 53 cities in global top 1,000, with strong manufacturing ties.

- France: Paris jumps to #12 globally per GSER, with unicorn growth. Over 30% growth rate; focuses on deep tech. 32 cities in global top 1,000.

- Netherlands: Amsterdam’s ecosystem thrives on logistics and cleantech. Benefits from EU market access; strong in fintech.

- Australia: Sydney and Melbourne lead in healthtech. Leverages Asia-Pacific trade; growth driven by government R&D tax incentives.

Analysis of Trends and Factors

The 2025 rankings reveal a shift toward diversified hubs, with Asia (Singapore) and Europe gaining ground on North America. Key drivers include government policies—Singapore’s grants and Israel’s military-tech pipeline—while challenges like U.S. regulatory scrutiny and Canada’s talent retention slow leaders. Funding trends show AI capturing 40% of global VC, benefiting tech-heavy nations like Israel and Sweden. Ecosystem maturity is evident: Top countries average 25% growth, but emerging ones like Singapore double that. Europe’s rise (six in top 10) stems from EU funding and cross-border talent mobility, contrasting Asia’s focus on fintech. Overall, sustainability and AI are pivotal, with hubs investing in green tech amid climate pressures. However, geopolitical risks (e.g., in Israel) and economic slowdowns could reshape 2026 rankings.

| Rank | Country | Key Strengths | Growth Rate | Cities in Global Top 1,000 | Notable Sectors |

|---|---|---|---|---|---|

| 1 | United States | Funding scale, talent pools | 18.2% | 81 | AI, Biotech |

| 2 | United Kingdom | Fintech hubs, policy support | 26% | 68 | Fintech, AI |

| 3 | Israel | Innovation density | 20.6% | 12 | Cybersecurity, Deep Tech |

| 4 | Singapore | Government incentives | 44.9% | N/A | Fintech, E-commerce |

| 5 | Canada | Multicultural talent | 18.8% | 39 | AI, E-commerce |

| 6 | Sweden | Sustainability focus | >30% | 19 | Music Tech, Cleantech |

| 7 | Germany | Manufacturing integration | 28.4% | 53 | Transportation, Auto |

| 8 | France | Unicorn growth | >30% | 32 | Deep Tech, Fashion |

| 9 | Netherlands | EU market access | N/A | N/A | Logistics, Cleantech |

| 10 | Australia | Asia-Pacific proximity | N/A | N/A | Healthtech, Mining |

This table compares the top 10 based on StartupBlink data, highlighting metrics like growth and sector focus.

Another perspective from the Global Startup Ecosystem Report (GSER) 2025 aggregates city ecosystems to countries, showing the U.S. dominant with multiple top cities (e.g., New York #2, Boston #5), followed by the UK (London #3) and China (Beijing #5, Shanghai #10). This reinforces the U.S.-UK lead but elevates China for scale, absent from StartupBlink’s top 10 due to ecosystem concentration.

| Country (Aggregated from GSER Top Ecosystems) | Number of Top 40 Ecosystems | Key Cities | Highlights |

|---|---|---|---|

| United States | ~10+ | New York (#2), Boston (#5), Philadelphia (#13) | Strong in exits and funding |

| United Kingdom | 1 | London (#3) | Slipped from #2 tie |

| China | 6 | Beijing (#5), Shanghai (#10), Shenzhen (#17) | All improved ranks |

| France | 1 | Paris (#12) | Up 2 spots, unicorn surge |

| India | 1 | Bengaluru (#14) | Up 7 spots |

FAQs on Top Startup Hubs in 2025

What makes the United States the top startup hub in 2025? The U.S. excels due to massive VC funding, world-class universities, and a culture of risk-taking, though growth is slowing as ecosystems mature.

Why did Singapore rise so quickly? Its government-backed programs, low taxes, and strategic location in Asia have attracted fintech and blockchain startups, achieving the highest growth rate in the top 10.

How does Europe compare to North America? Europe claims six spots in the top 10, driven by collaborative EU policies and sustainability focus, but lags in funding scale compared to the U.S. and Canada.

What role does AI play in these rankings? AI dominates investment, boosting hubs like Israel (cybersecurity-AI fusion) and Sweden (ethical AI), with global VC in the sector up 40% year-over-year.

Are there emerging threats to these top hubs? Geopolitical tensions in Israel, regulatory changes in the U.S., and talent shortages globally could shift dynamics, while rising hubs like India (22nd) show potential.

How can entrepreneurs choose a hub? Consider sector fit—fintech in Singapore, deep tech in Israel—alongside visas, taxes, and quality of life, as per NordicHQ’s ease-of-business metrics favoring places like Denmark and Estonia for startups.